35+ Inherited Ira Distribution Calculator

Spousal transfer treat as your own Option 2. Get Started in Your Future.

Calculating Required Minimum Distributions For Inherited Iras Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

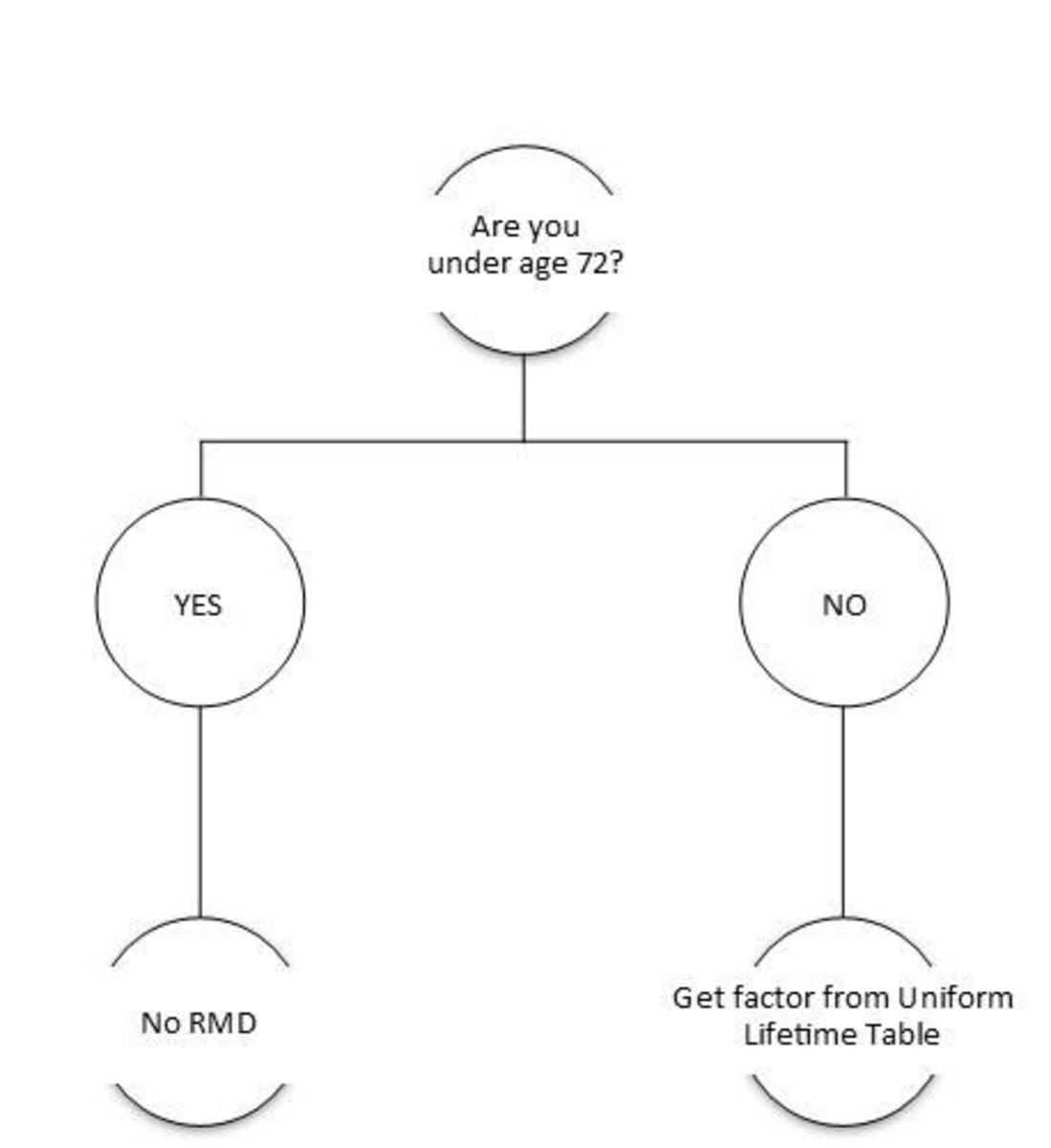

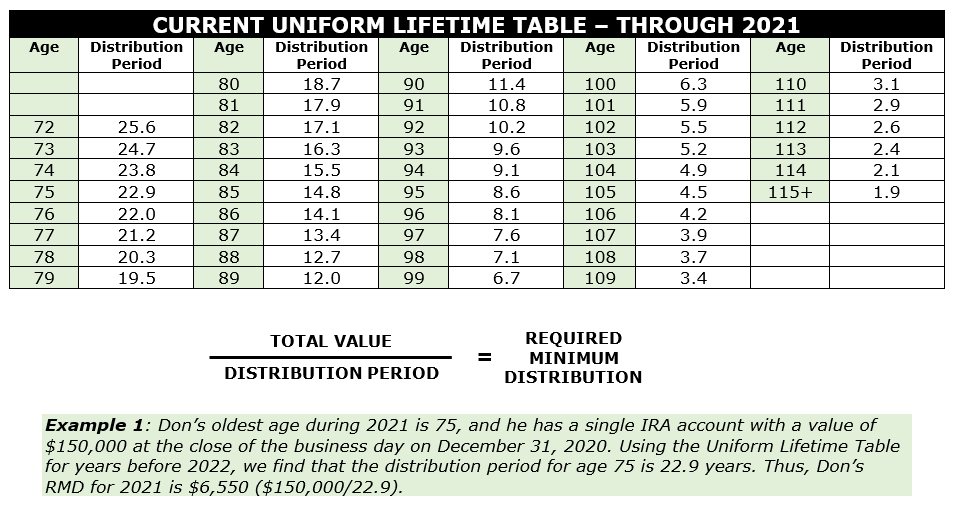

Determine your Required Minimum Distribution RMD from a traditional 401k or IRA.

. Open a Schwab IRA today. Ad Research Fund Options to Fit Your Investment Strategy. If youve inherited an IRA andor other types of retirement.

Plus review your projected RMDs over 10 years and over your lifetime. Web If inherited assets have been transferred into an inherited IRA in your name this calculator may help determine how much may be required to withdraw this year from. Web Use one of these worksheets to calculate your Required Minimum Distribution from your own IRAs including SEP IRAs and SIMPLE IRAs.

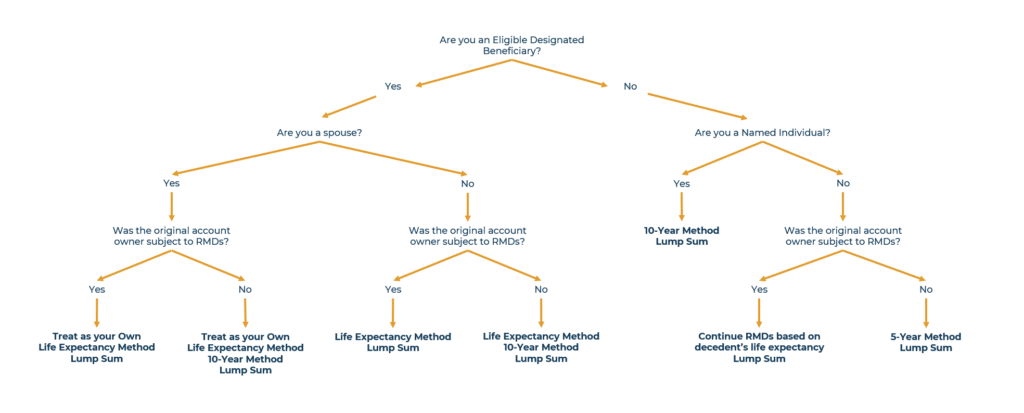

Schwab Offers Multiple Types Of IRAs. 10-year method Option 4. Web Calculating your required minimum distribution RMD for an inherited IRA depends on your personal situation and can be complicated - but were here to help.

Use our IRA calculators to get the IRA numbers you need. 401k Save the Max. Net Unrealized Appreciation NUA vs.

If you want to simply. Distribute using Table I. Web If youve inherited an IRA depending on your beneficiary classification you may be required to take annual withdrawalsalso known as required minimum distributions.

Web Use our RMD calculator to find out the required minimum distribution for your IRA. Paying taxes on early distributions from your IRA could be costly to your retirement. The IRS requires that you withdraw at least a minimum amount - known as a Required Minimum Distribution - from your retirement accounts annually.

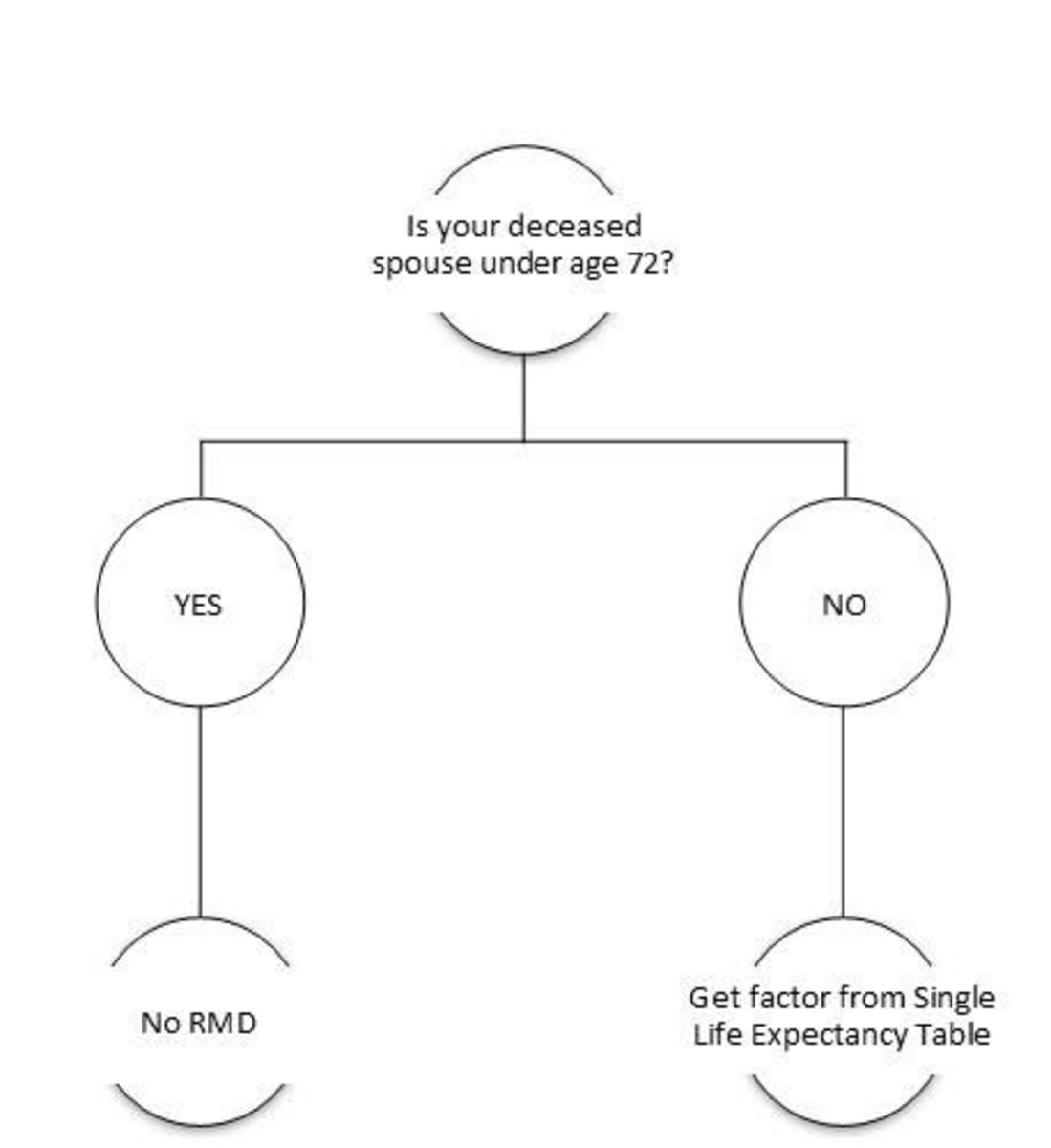

Use younger of 1 beneficiarys age or 2 owners age at birthday in year of death. Open an Inherited IRA. Web IRS updates timeline for ruling on inherited IRA distributions On July 14th the IRS released Notice 2022-54 waiving penalties for certain inherited retirement.

Web 36 rows This calculator determines the minimum required distribution known as both RMD or MRD which is really confusing from an inherited IRA based on the IRS single. Inherited IRA distribution rules have changed. IRA Rollover Calculator Inherited IRA Distributions Calculator.

Web Eligible designated beneficiaries can stretch distributions from inherited IRAs indefinitely beginning in the year after the death of the IRA owner and calculate. Were here to help. Web Use This Inherited IRA RMD Calculator to Maximize Your Inheritance Shawn Plummer CEO The Annuity Expert If you have recently inherited an IRA its crucial to understand.

Ad Learn more about Fisher Investments advice regarding IRAs taxable income in retirement. The new rules mean if you inherit an IRA from a non-spouse you have to deplete that account within 10. Due to the SECURE Act of 2019 most beneficiaries can no longer stretch.

Life expectancy method Option 3. Open an Inherited IRA. Discover Investment Opportunities and Build Your Financial Future.

Web RMD Calculator - Fidelity Investments. Simplify The Road To Retirement. Ad Learn more about Fisher Investments advice regarding IRAs taxable income in retirement.

Web I am an eligible designated or non-eligible designated beneficiary of the original IRA owner. Web Can take owners RMD for year of death. If you have inherited an IRA or have any other retirement plan account its important to be aware of the SECURE.

Learn More About Schwab IRAs And Start Investing Today. Web Inherited IRA RMD Calculator How much are you required to withdraw from your inherited retirement account s. Paying taxes on early distributions from your IRA could be costly to your retirement.

Web Calculate your earnings and more When you are the beneficiary of a retirement plan specific IRS rules regulate the minimum withdrawals you must take. Web Use our required minimum distribution RMD calculator to determine how much money you need to take out of your traditional IRA or 401 k account this year. Web 2 days ago1.

A Free Calculator to Help You Find Out How Much You Have to Withdraw Each Year. Web What Is My Current Year Required Minimum Distribution RMD. When you inherit an IRA or Roth IRA your distribution requirements will be based on.

Web This spread was eliminated by the SECURE Act that came around in 2020. Ad Build Assets Be Tax-Smart. Web Take the next step.

Discover The Answers You Need Here. Web 401k and IRA Required Minimum Distribution Calculator. Web However a 10-year rule now applies to many beneficiaries of inherited IRAs.

Ad Use This Calculator to Determine Your Required Minimum Distribution.

A Guide To Required Minimum Distributions Rmds

0400 0788 Tab C Exs 16 B 25 F Public Pdf Individual Retirement Account Clearing Finance

The Ultimate Practice Building Library Ultimate Estate Planner

Ira Rmd Calculator 2023

What To Do If You Inherit An Ira Post Secure Act Wealthspire

Inherited Ira Rmd Calculator Voya Com

Required Minimum Distributions Rules Heintzelman Accounting Services

Ira Rmd Calculator 2023

2018 Rules To Calculate Required Minimum Distributions Rmds

Excel If Between Two Numbers Or Dates

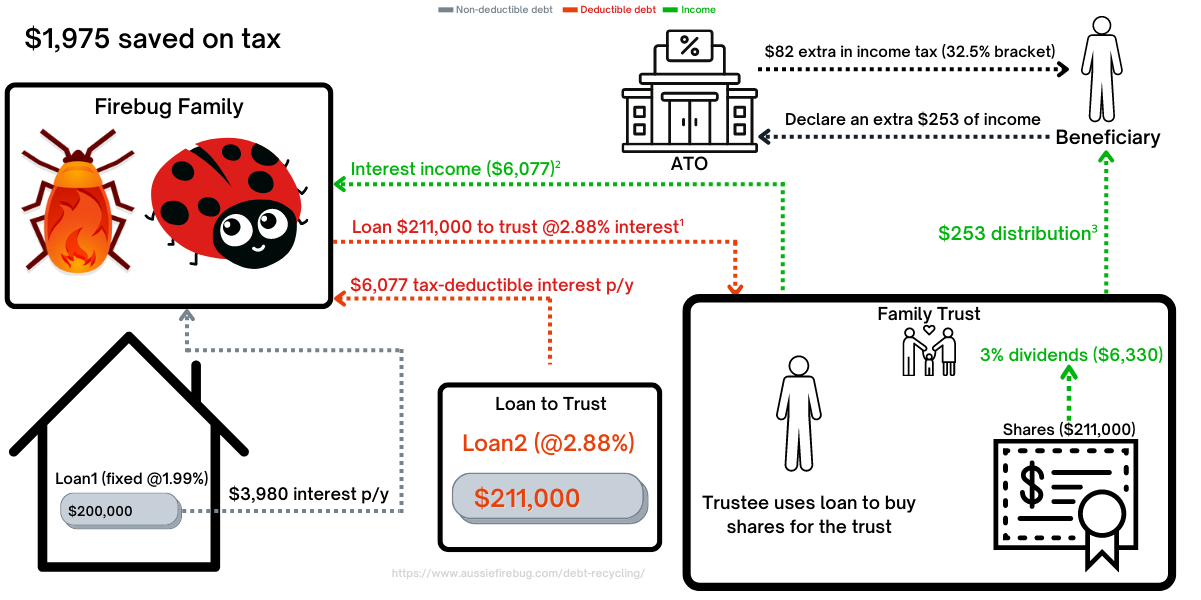

Classics Archives Aussie Firebug

Horsesmouth Savvy Ira Planning For Boomers

Rmd Tables For Iras

Horsesmouth Savvy Ira Planning For Boomers

Calculating Required Minimum Distributions For Inherited Iras Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

Required Minimum Distribution Alternatives For Ira Beneficiaries

Required Minimum Distribution Calculator Investor Gov